The Deed Tax Law of People’s Republic of China (PRC) (hereinafter referred to as the Deed Tax Law) shall come into force on September 1, 2021, and the Provisional Regulations on Deed Tax of People’s Republic of China (PRC) (hereinafter referred to as the Provisional Regulations) shall be abolished at the same time. Has the deed tax rate really increased? Compared with the Provisional Regulations, which provisions of the Deed Tax Law have changed and which have not? Don’t worry, we’ve arranged it for you.

1. The statutory tax rate has not changed.

The Deed Tax Law maintains the tax rate of 3% ~ 5% as stipulated in the Provisional Regulations, and does not increase it. It only adjusts the procedure for determining the applicable tax rate according to the principle of statutory taxation: it is determined by the provincial people’s government and put forward by the provincial people’s government and reported to the Standing Committee of the People’s Congress at the same level for decision, and then put on record according to regulations.

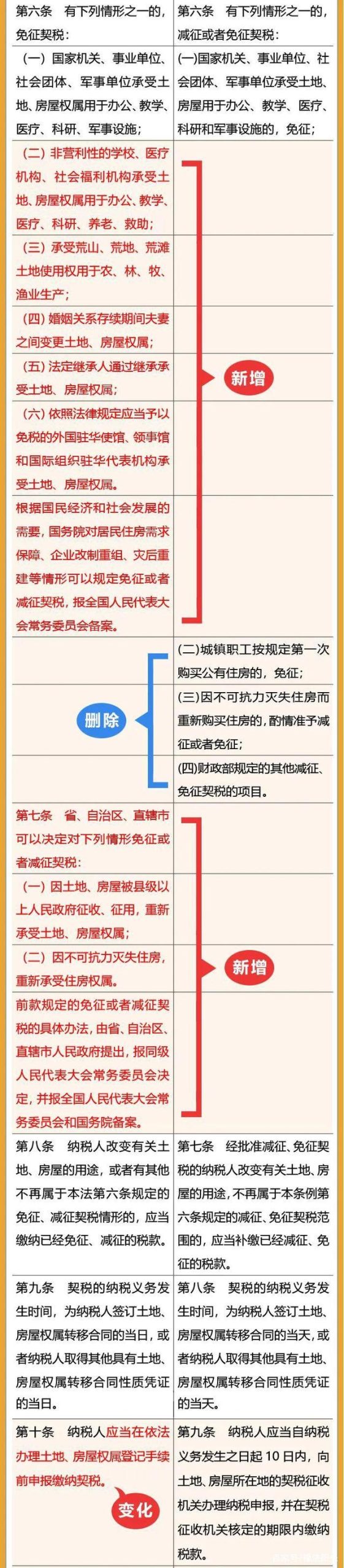

Second, the scope of taxation has been slightly adjusted.

The scope of taxation stipulated in the Deed Tax Law has been slightly adjusted, and the most important thing is to include the "transfer of collectively operated construction land" in the scope of taxation.

Third, the preferential targets have been expanded.

On the basis of the original preferential treatment, the Deed Tax Law has added provisions to exempt some non-profit organizations from deed tax. At the same time, the Deed Tax Law makes it clear that if the ownership of land and house is changed between husband and wife during the marriage relationship, the legal heirs can enjoy the privilege of exemption from deed tax by inheriting the ownership of land and house.

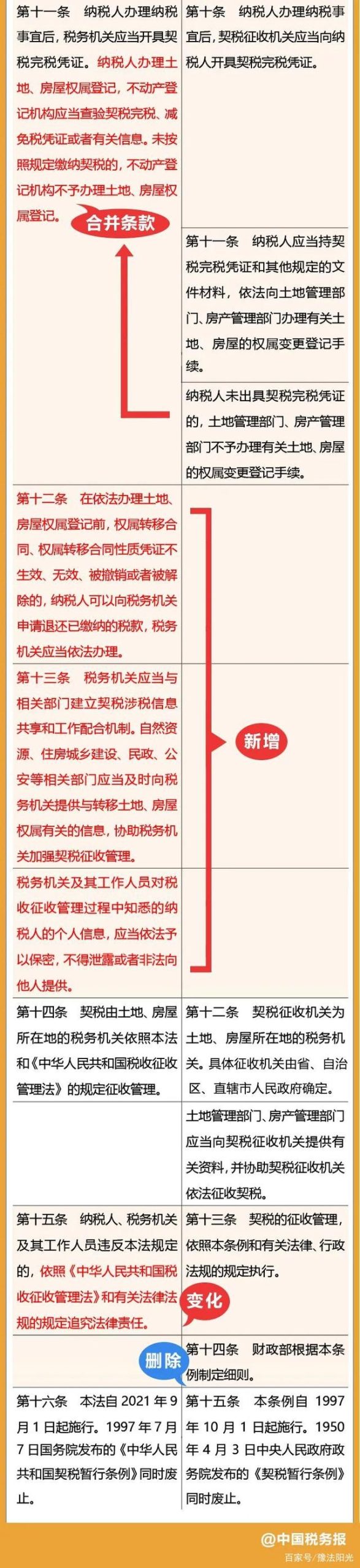

Fourth, it is more convenient to declare and pay taxes.

The Deed Tax Law combines the declaration period and the tax payment period into one, so taxpayers can complete the declaration and tax payment at one time before going through the registration formalities of land and house ownership.

Fifth, the rights and interests of taxpayers are more secure.

The Deed Tax Law also clarifies the tax refund situation and strengthens the confidentiality of tax-related information, which is an important embodiment of fully protecting taxpayers’ rights and interests.

See the following table for details of specific changes:

People’s Republic of China (PRC) deed tax law

(Adopted at the 21st meeting of the 13th the NPC Standing Committee on August 11th, 2020)

Article 1 The units and individuals who transfer the ownership of land and houses within the territory of People’s Republic of China (PRC) are taxpayers of deed tax and shall pay the deed tax in accordance with the provisions of this Law.

Article 2 The transfer of ownership of land and houses as mentioned in this Law refers to the following acts:

(a) the transfer of land use rights;

(two) the transfer of land use rights, including sale, gift and exchange;

(three) the sale, gift and exchange of houses.

The transfer of land use right mentioned in the second paragraph of the preceding paragraph does not include the transfer of land contractual management right and land management right.

Where the ownership of land and houses is transferred by means of fixed-price investment (share purchase), debt repayment, transfer or reward, deed tax shall be levied in accordance with the provisions of this Law.

Article 3 The deed tax rate is 3% to 5%.

The specific applicable tax rate of deed tax shall be proposed by the people’s governments of provinces, autonomous regions and municipalities directly under the Central Government within the tax rate range specified in the preceding paragraph, submitted to the Standing Committee of the people’s congress at the same level for decision, and reported to the NPC Standing Committee and the State Council for the record.

Provinces, autonomous regions and municipalities directly under the Central Government may, in accordance with the procedures prescribed in the preceding paragraph, determine different tax rates for the transfer of ownership of different subjects, different regions and different types of housing.

Article 4 Tax basis for deed tax:

(a) the transfer and sale of land use rights, the sale of houses, the transaction price determined for the transfer contract of land and house ownership, including the money to be delivered and the price corresponding to the physical objects and other economic benefits;

(two) land use rights swap, housing swap, the difference between the exchanged land use rights and housing prices;

(3) The land use right gift, house gift and other transfer of land and house ownership without price are the prices legally approved by the tax authorities with reference to the market price of land use right sale and house sale.

If the difference between the transaction price and the swap price declared by the taxpayer is obviously low without justifiable reasons, it shall be verified by the tax authorities in accordance with the provisions of the Law of People’s Republic of China (PRC) Municipality on the Administration of Tax Collection.

Article 5 The taxable amount of deed tax shall be calculated by multiplying the tax basis by the specific applicable tax rate.

Article 6 Under any of the following circumstances, the deed tax shall be exempted:

(1) State organs, institutions, social organizations and military units shall inherit the ownership of land and houses for office, teaching, medical care, scientific research and military facilities;

(two) non-profit schools, medical institutions, social welfare institutions to bear the ownership of land and housing for office, teaching, medical care, scientific research, pension, relief;

(three) bear the barren hills, wasteland, wasteland land use rights for agriculture, forestry, animal husbandry and fishery production;

(four) during the marriage relationship between husband and wife to change the ownership of land and housing;

(five) the legal heir to inherit the ownership of land and housing through inheritance;

(six) foreign embassies, consulates and representative offices of international organizations in China that should be exempted from tax according to the law shall inherit the ownership of land and houses.

According to the needs of national economic and social development, the State Council can provide for the exemption or reduction of deed tax for the housing needs of residents, enterprise restructuring and post-disaster reconstruction, and report it to the NPC Standing Committee for the record.

Article 7 Provinces, autonomous regions and municipalities directly under the Central Government may decide to exempt or reduce deed tax in the following cases:

(a) because the land and houses are expropriated and requisitioned by the people’s governments at or above the county level, the ownership of the land and houses is re-assumed;

(two) the loss of housing due to force majeure, to bear the ownership of housing.

Specific measures for the exemption or reduction of deed tax stipulated in the preceding paragraph shall be proposed by the people’s governments of provinces, autonomous regions and municipalities directly under the Central Government, submitted to the Standing Committee of the people’s congress at the same level for decision, and reported to the NPC Standing Committee and the State Council for the record.

Article 8 Taxpayers who change the use of relevant land and houses, or have other circumstances that no longer belong to the exemption or reduction of deed tax as stipulated in Article 6 of this Law, shall pay the tax that has been exempted or reduced.

Article 9 The time when the obligation to pay taxes on deed tax occurs is the day when the taxpayer signs the land and house ownership transfer contract, or the day when the taxpayer obtains other certificates with the nature of the land and house ownership transfer contract.

Tenth taxpayers should declare and pay the deed tax before going through the registration formalities of land and house ownership according to law.

Article 11 After a taxpayer handles tax payment, the tax authorities shall issue deed tax payment vouchers. Taxpayers handle the registration of land and house ownership, and the real estate registration agency shall check the deed tax payment, tax reduction or exemption certificate or relevant information. If the deed tax is not paid in accordance with the regulations, the real estate registration agency shall not handle the registration of land and housing ownership.

Article 12 Before the registration of land and house ownership in accordance with the law, if the ownership transfer contract or the nature certificate of the ownership transfer contract is invalid, invalid, revoked or cancelled, the taxpayer may apply to the tax authorities for refund of the tax paid, and the tax authorities shall handle it according to the law.

Thirteenth tax authorities shall establish a deed tax information sharing and cooperation mechanism with relevant departments. Natural resources, housing and urban construction, civil affairs, public security and other relevant departments shall provide the tax authorities with information related to the transfer of land and housing ownership in a timely manner, and assist the tax authorities in strengthening the management of deed tax collection.

The tax authorities and their staff shall keep confidential the personal information of taxpayers they know in the process of tax collection and management, and shall not disclose or illegally provide it to others.

Article 14 The deed tax shall be collected and managed by the tax authorities where the land and houses are located in accordance with this Law and the Law of People’s Republic of China (PRC) on Tax Collection and Management.

Fifteenth taxpayers, tax authorities and their staff in violation of the provisions of this law, in accordance with the "People’s Republic of China (PRC) tax collection and management law" and the provisions of relevant laws and regulations shall be investigated for legal responsibility.

Article 16 This Law shall come into force as of September 1, 2021. On July 7, 1997, the Provisional Regulations on Deed Tax in People’s Republic of China (PRC) issued by the State Council was abolished at the same time.

Source: China Tax News, New Media, Legal Home.

Reporting/feedback