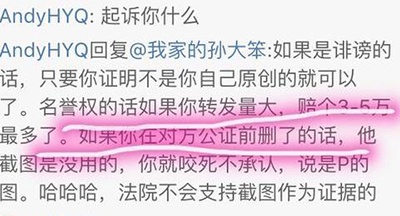

Notes on Exchange Rate of Panda Notes

There are eleven articles in this series, and the pen and ink focus on RMB exchange rate. Panda traders reveal the most real economic phenomenon in China financial market by analyzing the relationship between onshore and offshore RMB flows.

In order to satisfy readers who love learning, the administrator has compiled the exchange rate articles of panda trading notes into a comprehensive collection, including "How big is CNH’s short position?" Taiwan Province Teammates of CNH Bears, The Secret of CNH Short-term Interest Rate Surging, The Great Instrument to Deal with CNH Bears, and Looking at CNH’s forward price increase and discount as expected, you are laid off! Eleven trading notes: CNH Arbitrators Made a Lot of Money from Mother Yang; August Central Bank Report Tells the Most Wonderful Story of China in Recent Years; Mother Yang and His Xiong Haizi; Other People’s Mothers; Players and Chips; Mother Yang’s Wild Hope. Pay attention to WeChat official account’s "RMB Trading and Research" and reply to the keyword "Panda Trading Notes" to get a collection of articles.

"This article is a speech prepared for a seminar in May 2015. Four months later, the development of the situation is still completely evolving along with the analysis at that time, so let’s take a look back at the recent fluctuations in interest rates and exchange rates at home and abroad. In order to maintain the integrity of the analysis at that time, I deliberately didn’t even update the data. Interested readers should update the latest data on the website of the Hong Kong Monetary Authority and Bloomberg to see what changes have taken place in the trend. -Panda

Recently, many readers have left messages in the background with one key word: panda trader! Twelve years after the financial crisis, a new generation of traders began to review the classics in order to have a deeper understanding of the international market.

What a relief! This piece of gold was first discovered by me, so I was authorized to edit more than 20 earliest core articles of panda traders! Of course, gold itself will shine. Panda trader is now a big blind trader, and readers will occasionally listen to him on some high-end forums where elites gather.

There are more than 20 articles in this series, and I will find an opportunity to resend them one by one, so please keep them. There is also a collection version of PDF, leave an email in the background, and I will send it to you if I have one.

Thank you, panda trader! Five years later, there were a bunch of messages backstage looking for your articles. This is a legend!

The topic of this speech is the prospect of foreign-funded institutions entering the interbank market. The scope of foreign-funded institutions is very wide, and I intend to limit it to those institutions that have the greatest impact on China’s bond market, that is, large and medium-sized European and American global institutional investors who are going to allocate part of their assets in the RMB bond market. My view is that in the medium term, about one to three years, they may become a considerable force, but in the short term, or within one year, it may be difficult to see a decent asset allocation.

Before discussing this problem, it will be helpful to analyze several topics first.

I bond asset allocation and foreign exchange allocation mode of large international institutional investors

Investment varieties

The bond market is rich in varieties. It is generally believed that national debt, or generalized sovereign bond, generally refers to institutions guaranteed by the state or implicitly, such as Fannie and Freddie in the United States, KFW in Germany and EIB in Europe, and we have well-known policy banks in China), which are mainly influenced by macro-economic and monetary policies. However, credit bonds, because they involve the study of corporate issuers and credit environment, are traditionally considered as varieties that need strong local research strength to carry out investment. A special kind of product is ABS. Although it is still very new and mysterious to domestic investors, the bond PM of international institutions generally has rich ABS experience, which recognizes the characteristics of ABS risk dispersion, low leverage ratio and high recovery rate, and its acceptance of ABS is actually higher than that of credit bonds.

Foreign exchange model

Investing in non-local currency markets will naturally involve foreign exchange risks. Bond volatility is low and foreign exchange volatility is high. Without hedging, it is easy to lose all the hard-earned bond Carry on foreign exchange. Therefore, mainstream asset management institutions are used to managing foreign exchange positions separately, which is called FX Overlay. Rich derivatives in the foreign exchange market, such as FX Swap/FX Forward, provide convenience for adjusting foreign exchange positions without using cash. A bond portfolio may have 40% investment in US Treasury bonds and 60% investment in German Treasury bonds, but 70% position is USD and 30% position is EUR. It is even possible to invest in bonds yourself and outsource FX Overlay to other institutions specializing in foreign exchange.

If FX Overlay is stripped off, we only look at the bond position. Considering that the non-local currency position FX Overlay liabilities are at the short end, while the bond Asset assets are at the long end, this will return to the familiar Carry mode of our bond PM, so Carry is more important than Nominal Yield for non-local currency bonds.

Second, the wonderful Yield of CNH market

The interest rate of offshore RMB in Hong Kong has always deviated greatly from that of onshore RMB, and has greatly converged since 2014. However, due to some systematic factors, these strange deviations still persist. For example, offshore RMB deposits have been pitifully low from 2011 to the first half of 2014, but they began to soar in the second half of 2014, and there was a one-year interest rate of 4% in the fourth quarter. This year, after the People’s Bank of China cut interest rates and lowered the RRR several times, the downward trend of CNH deposit interest rate was quite limited, and the CNH interest rate of some banks was even higher than the CNY interest rate of the same domestic banks. This phenomenon, contrary to our familiar knowledge that raising interest rates creates a strong exchange rate and lowering interest rates suppresses the exchange rate, cannot be explained simply by speculating on the RMB exchange rate.

The reason for this phenomenon is the role of Hong Kong banks in RMB carry trade. Since 2012, cross-border arbitrage and RMB exchange rate speculation have become increasingly active, and overseas residents and enterprises have great demand for CNH. With these demands, Hong Kong banks not only provide trading channels as middlemen and counterparties, but also directly participate in carry trade, so CNH long positions are formed in exchange rate and huge CNH Spot long /Forward short positions are formed in derivatives (this is equivalent to CNH interest rate long positions). Note that when deriving CNH positions, the derivation of deposits and loans in monetary banking is also applicable to offshore markets. The following figure shows that the ratio of current and fixed deposits of CNH in Hong Kong fluctuates between 1: 7 and 1: 10, while that of the United States is reversed. Even in the domestic monetary banking system dominated by the banking industry, the ratio of current and fixed deposits is generally around 1: 2. It is conceivable that banks have played a cruel role in CNH market.

As for the specific CNH Spot long /Forward short exposure of banks, Goldman Sachs once estimated that the total CNH long-term short position of Hong Kong banking industry in October 2013 was US$ 45 billion according to the Bank Other FX in Banking Statistics published by Hong Kong Monetary Authority. According to Goldman Sachs’ method, I calculated that even after the People’s Bank of China took the initiative to guide the exchange rate in early 2014, Hong Kong banks still provided CNH carry positions on a large scale, reaching a peak of $85 billion in August 2014, and then rapidly reduced them, but as of February 2015, there were still about $50 billion CNH long-term short positions. The above-mentioned positions are Long Spot/Short Forward. In terms of net exchange rate exposure, I calculated by the same method that the Hong Kong banking industry has been a CNH exchange rate bull since 2013, with a position of about US$ 15 billion at the peak in August 2014 and about US$ 10 billion as of February 2015. In contrast, mainstream currencies such as the euro and the Japanese yen have flat net foreign exchange exposure most of the time. Because of the close integration with banking, the foreign exchange forward has a higher exposure, but it rarely exceeds 15 billion US dollars, far less than the amount of CNH.

It should be pointed out that this model is not the only one that affects CNH. Other factors, such as the promotion of capital account opening and the demand for RMB assets formed by Shanghai-Hong Kong Stock Connect, may also have a significant impact on CNH. However, considering that the cross-border RMB flow has not changed substantially, I think it is more likely that this model will still dominate the changes in CNH market.

CNH derived from the banking system and a huge amount of CNH formed through other channels, such as arbitrage, cannot be circulated through normal deposit and loan methods, and can only be accumulated in the banking system. On the one hand, according to this model, the bank itself is a long interest rate. On the other hand, the interest rate for customers is set by the bank itself, so it is natural to suppress the deposit interest rate for the purpose of controlling its own costs. For investors, on the one hand, in addition to limited investment channels such as dim sum bonds, RQFII or illegal return channels (false trade), only banks that love to save and not roll over deposit, on the other hand, because the main investment purpose is to appreciate the Bo exchange rate, they are not particularly sensitive to interest rates. Therefore, before 4Q2014, the benchmark interest rate of CNH market was quite low, the demand interest rate was close to 0, and the one-year deposit interest rate was rarely 2%. The slightly long-term CNH CCS is even as low as the level of no discipline. For example, the 3-year CNH CCS was only about 1.3% in mid-2013. If an issuer has both US dollar debt and a little debt, the bond PM will find that he Swap US dollars into CCS and then buys some debt, which can be 200Bps more Carry and 200Bps annual risk free yield than directly buying US dollar debt!

However, this model will not work since 4Q2014. The downward trend of China’s economy is no longer a "wolf", but a real threat. For the first time, USD/CNY 12M NDF has a Premium of more than 2400Bps, which means that Long CNY/Short USD will be a loss, not a gain (so if you say USD/CNY NDF Premium is expected to depreciate, please consciously think about it. Apart from the CNH exchange rate, there is a greater fear for the Hong Kong banking industry, that is, the accumulated huge amount of US dollar and Hong Kong dollar loans in China. Therefore, the banking industry in Hong Kong is uncharacteristically trying to reduce the position of Long CNH in the Spot market and the position of Long Spot/Short Forward in the Forward market. In this case, not only the exchange rate of CNH is under pressure, but also the interest rate is suddenly facing tremendous upward pressure. At the end of 2014, banks with a one-year fixed deposit of more than 4% were everywhere.

The agitation of the exchange rate market finally angered Yang Ma. In March, 15, Yang Ma made a small punishment and beat the speculators. Since then, CNY and CNH exchange rates have been operating with rare stability in history, which has somewhat appeased the Hong Kong banking industry. Everyone expressed that the interest rate was too high, so they all went back to 3% from 4%, but the pace of cutting CNH positions did not dare to slow down at all, and naturally short-term interest rates could not return to the past. An interesting phenomenon is that although there are news reports that high interest rates in Hong Kong’s banking industry attract CNH deposits, in fact, CNH deposits in Hong Kong’s banking industry are declining, not rising.

For PM with US dollar as its local currency, it is unprofitable whether it is an Unhedged position with exchange rate and interest rate, or a short-end Carry with Swap financing, or a Duration Matched Arbitrage with CCS, so the dim sum bond market has been weak since 2015. Issuers are very happy, because they can complete the financing at a very low price. If duration matched is used as CCS for the four-year Baodao bond issued by Goldman Sachs in March 2015, the financing cost can be as low as USD 3mL+55Bps, which is less than 1% at the time of issuance.

After discussing the above two lemmas, let’s get to the point: the prospect of foreign capital entering the inter-bank bond market.

Positive factors:

1, the regulatory authorities to encourage

Before 2014, out of disgust for interest rate and exchange rate speculators, the People’s Bank of China severely restricted foreign asset management institutions from entering the China bond market. Only overseas RMB clearing banks, sovereign wealth funds of foreign central banks and RQFII were allowed to enter. As for RQFII, only Hong Kong subsidiaries of domestic institutions can enter at first, and then it has gradually expanded to local asset management institutions in Hong Kong. In 2014, with the acceleration of RMB internationalization and the gradual withdrawal of arbitrage positions, the People’s Bank of China has been much more friendly to overseas institutions. RQFII has expanded from Hong Kong to Britain, Singapore, South Korea, etc. In addition to the subsidiaries of domestic institutions and local institutions in Hong Kong, there are also well-known international institutional investors such as Ashmore, UBS, Schroder, Nikko. QFII has also changed from encouraging stock investment to encouraging stock bonds.

After 2h, 2014, high-level officials repeatedly mentioned using overseas funds to reduce the financing interest rate, and the RMB exchange rate turned sharply, so the People’s Bank of China has been very friendly to foreign investment in the inter-bank bond market. At present, although there are still problems such as QFII/RQFII quota approval and limited operation (PIMCO’s QFII quota is only $100 million, will I talk nonsense? ), but considering the attitude of regulators, foreign capital will continue to enter the interbank market at the policy level.

The varieties that foreign investors are interested in are expected to be mainly treasury bonds/policy bank bonds/central bank bills for a long time, and some of the more active funds may be interested in credit bond issuers with international ratings, such as PetroChina, which have contacted the international market. If it runs well, some foreign investors will be interested in ABS/MBS. Credit bonds may take a long time until the credit culture in China can be understood by international investors.

2. Decentralized value provided by RMB bonds

On a global scale, considering the low interest rates in the United States, Europe and Japan and the fragility of emerging markets, China can provide a good rate of return, but the bond market with relatively acceptable risks is really rare. What’s more, the correlation between China market and other international markets is extremely low. The following figure is a comparison of the monthly returns and correlation (100% USD Hedged) of major government bond indexes of Merrill Lynch in the first 10 years from 2005 to 2014, so you can see where China’s national debt is. China bonds are ideal investment targets for international institutional investors who want to diversify their risks from the US dollar market.

Disadvantages:

1. The domestic RMB bond investment and trading mode is far from a mode that makes foreign-funded institutions feel comfortable in global allocation.

As mentioned above, foreign-funded institutions have the following options for making non-local currency bonds:

(1) manage foreign exchange exposure in the traditional FX Overlay way, and mainly earn bond Carry. This model is difficult to operate in China. Why? Just look at the monthly trading data of foreign exchange derivatives published by the foreign exchange trading center.

(2) Allocate RMB directly without foreign exchange hedging. If it is 2013, this method is certainly very good, but now it is necessary to have true love for the RMB exchange rate to do this mode of foreign exchange bond exposure together.

Other possible disturbing factors, including trading mode and operational risk, will not be described one by one. In short, from my experience in contact with international institutional investors, to convince these institutional investors, we need to convince them to accept possible risks first, which is more important than income in many cases.

2. The CNH market is ahead of CNY, and it is difficult to see the pursuit of CNY before the burden of CNH is digested.

The CNH/ dim sum debt market, which is "inadvertently inserted into the willows", has developed to the present, and its scale is not small, nearly 400 billion yuan. The issuers are not only the Ministry of Finance, CDB, Chinese-funded and Hong Kong-funded institutions, but also many big-name European and American companies. The trading mode is a familiar market maker mode for foreign investors. Market makers are old business partners such as Goldman Sachs and Merrill Lynch and other foreign investment banks. The legal system is Anglo-American legal system. What is even more rare is that FX Swap/Forward and other foreign exchange instruments are complete and abundant. PM accustomed to European and American markets can be very comfortable in CNH market, as long as it can tolerate relatively poor liquidity. Therefore, although foreign capital entered the inter-bank market very late, it has a long history to invest in RMB bonds. Since 2010, European institutional investors have appeared in the dim sum debt market in Hong Kong, and they have made some money in recent years. However, the problem is that it is difficult for the dim sum debt market to turn over before the CNH burden of the Hong Kong banking industry has been digested. The following figure shows that the yield of 5-year dim sum bonds has actually been higher than that of 5-year domestic bonds since 2015. Then, for a PM who can do dim sum debt, even if he loves RMB again, it is difficult to persuade him to give up the opportunity to pick up bargains comfortably in the dim sum debt market and join the domestic interbank market.

Therefore, it is unlikely that the foreign Salvation Army will reinforce the interbank market in a big way in the short term, and the Advent faction can wash and sleep first. In the initial stage, considering the potential of the RMB bond market, many foreign-funded institutions may actively deploy and even begin to actively trade in the inter-bank bond market. However, it will take another 1-3 years for the inter-bank market to really attract asset allocation funds from global institutional investors, and it will also take another 1-3 years under the premise that the economic fundamental risks can be effectively resolved, the exchange rate is basically stable, and the Carry and Correlation of the bond market against the US dollar have not changed much. However, funds from East Asia, such as Hongkong, Taiwan Province, Singapore and South Korea, may be more active. They are often not so detailed and can accept the direct allocation of RMB.

References:

1. EM Macro Daily – A look at CNH flows via Hong Kong bank’s positions data, Goldman Sachs Research, Feb 5th, 2014.

2. Reading the Signs on RRR: Topline Pressure for Offshore Banks; What will BOCHK/HSB Do With Capital? Jp Morgan equity research, feb 05th 2015 (end)

This article first appeared on WeChat WeChat official account: RMB Trading and Research. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.

(Editor: Ji Liya HN003)