The introduction of residence permit is an important measure for the reform of household registration system, which enables new urban residents to enjoy the same rights and interests as local residents. The picture shows migrant workers consulting the residence permit processing process at Dahuoquan Police Station of Qiaoxi Branch of Xingtai Public Security Bureau. Xinhua News Agency reporter Zhu Xudong photo

The picture shows the staff of the grid "Minsheng 110" service center in Shaowu City, Fujian Province, handling the help-seeking service of the masses. Xinhua News Agency reporter Lin Shanchuan photo

1. The background and objectives of social governance concept.

The Decision of the Central Committee of the Communist Party of China on Several Major Issues of Comprehensively Deepening Reform adopted by the Third Plenary Session of the 18th CPC Central Committee pointed out that "the overall goal of comprehensively deepening reform is to improve and develop the Socialism with Chinese characteristics system and promote the modernization of the national governance system and governance capacity". The Central Committee of the Communist Party of China’s Proposal on Formulating the Thirteenth Five-Year Plan for National Economic and Social Development, adopted by the Fifth Plenary Session of the 18th CPC Central Committee, further holds that strengthening and innovating social governance is an important starting point for strengthening and improving the Party’s leadership and providing a strong guarantee for the realization of the 13th Five-Year Plan.

The application of the concept of "social governance" has gone through a process in understanding — — Before the Third Plenary Session of the 18th CPC Central Committee, we mainly used the concept of "social management". Since the Third Plenary Session of the 18th CPC Central Committee adopted "the Central Committee of the Communist Party of China’s Decision on Comprehensively Deepening Reform", our party began to replace "social management" with the concept of "social governance". The transformation from social management to social governance is not a simple "one-word change", it reflects the obvious differences in governance subject, governance mode, governance scope and governance focus, and it is a profound summary of our party’s experience in dealing with social problems and solving social contradictions in the new period of reform, opening up and socialist modernization, and reflects the important theoretical and practical achievements made by the CPC Central Committee with the supreme leader as the general secretary in China’s social construction.

Innovating social governance has become a very important task to innovate government behavior. The Fourth Plenary Session of the 16th CPC Central Committee, held in September 2004, proposed for the first time to "establish and improve the social management pattern of party committee leadership, government responsibility, social coordination and public participation." In the report of the 17th National Congress of the Communist Party of China in 2007, it was put forward: "We should improve the social management pattern of party committee leadership, government responsibility, social coordination and public participation, and improve the grass-roots social management system." In 2010, 35 comprehensive pilot projects of social management innovation were identified nationwide, and the "Guiding Opinions on Comprehensive Pilot Projects of Social Management Innovation in China" was formulated. In November 2012, the 18th National Congress of the Communist Party of China proposed to "strengthen social construction in improving people’s livelihood and innovative management". In November 2013, the Third Plenary Session of the 18th CPC Central Committee decided to "innovate the social governance system", and put forward the principle requirements from four aspects: improving the social governance mode, stimulating the vitality of social organizations, innovating the system for effectively preventing and resolving social contradictions, and improving the public security system. In October 2014, the Fourth Plenary Session of the 18th CPC Central Committee proposed that we should adhere to systematic governance, legal governance, comprehensive governance and source governance, and improve the level of legalization of social governance. The Fifth Plenary Session of the 18th CPC Central Committee held in November 2015 proposed to strengthen and innovate social governance. We will build a safe China, improve the social governance system under the leadership of Party committees, government-led, social coordination, public participation and the rule of law, and promote the refinement of social governance.Construct a social governance pattern that all people build and share. "Strengthening", "Perfecting" and "Innovating" social governance is getting stronger and stronger, theoretical research is getting deeper and deeper, governance ideas are getting clearer and clearer, and the connotation, extension and focus of social governance are getting clearer and clearer, which has laid a good foundation for realizing the scientificity of social governance.

First of all, to strengthen and innovate social governance, we must firmly grasp the general requirement of maximizing social vitality, maximizing harmonious factors and minimizing disharmonious factors. The general requirements of "three maximums" embody two meanings: one is to stimulate social vitality, and the other is to achieve social stability and order by increasing harmonious factors and reducing disharmonious factors. The Third Plenary Session of the 18th CPC Central Committee pointed out that it is necessary to "accelerate the formation of a scientific and effective social governance system to ensure that the society is full of vitality and harmonious and orderly." This is the goal of our efforts to establish a scientific and effective social governance system and mechanism, the general task and requirement of strengthening and innovating social governance, and a very important content of promoting the modernization of the national governance system.

Secondly, vitality and order, development and stability are dialectical and unified relations, which cannot be neglected. Maintaining stability in development and maintaining the unity of opposites in development should be a basic principle for us to innovate social governance and deepen social system reform. At present, one of the main problems in strengthening and innovating social governance in China is that the relationship between stimulating social vitality and maintaining social stability is not properly handled. When we need to choose between stability and development, we tend to pay more attention to the former than the latter, that is, we pay more attention to stability and order than to vitality and development. Therefore, it must be deeply realized that maintaining social stability is only one aspect of social governance, and building a dynamic, stable and orderly society is the real purpose of social governance, and the two must be promoted together. In short, the goal of social governance is to achieve a dynamic balance between stability and vitality.

2. Current problems and challenges in the field of social governance in China

China’s economy has entered a "new normal", which is faced with a shift in growth rate, a painful period in structural adjustment and a digestive period in previous stimulus policies. Therefore, the problems encountered in the field of social construction will be more and more complicated. It is very urgent and important to maintain the long-term stability of society and strengthen and innovate social governance.

(1) Social problems are frequent and sudden. The mass incidents in some places every year are the concentrated expression of this problem, which urgently requires innovative social governance. This problem mainly focuses on personnel treatment, land expropriation, wages and benefits, house demolition, law-related litigation and other areas of interest. To sum up, there are four main categories: first, the contradiction between low-income groups and middle-and high-income groups that reflect the distribution relationship; second, the contradiction between farmers and citizens that reflect the urban-rural relationship; third, the contradiction between employees and employers that reflect the labor relationship; and fourth, the contradiction between the governor and the governed that reflect the relationship between the party and the masses. These four aspects are related in essence, which together indicate the frequent problems, increasing contradictions and risk accumulation in the social transformation period. Therefore, paying attention to social security, preventing and resolving social risks, innovating social governance and establishing a new social operation order have become important topics in the transitional society. In other words, frequent social problems force social governance innovation.

(2) The increasing social mobility, while promoting the transformation from "unit person" to "social person" and "community person", puts forward new requirements for the focus of social governance. According to relevant statistics, in the total urban employment population, "unit people" used to account for more than 95%, but now this proportion has dropped to about 30%. In 2010-2015, the number of floating population in China remained above 200 million, and a large number of "unit people" have changed to "social people". The scale of social mobility has become larger and larger, and cross-regional mobility has become a normal state. The great transformation of social members from unit people to social people and community people has brought many new problems and new problems to social governance, and the traditional social governance models and methods have been seriously challenged.

(3) profound changes in the social stratum structure. The multi-subjects in the market brought about by the market-oriented reform have changed the single ownership structure, and at the same time, how to coordinate the demands of different classes and different interest groups has put forward new requirements for social governance. We believe that an important task to promote the modernization of the national governance system and governance capacity at present is to make an in-depth investigation and study on the interests of all walks of life in China and their development and change trends. On this basis, we should reform the original system, formulate new policies and measures as soon as possible, coordinate the interests of all social strata, and gradually establish an interest distribution system and mechanism that adapts to the socialist market economic system. By deepening the reform in an all-round way, we will strive to coordinate the interests of all social strata and build a society in which everyone enjoys the "sense of gain" of reform.

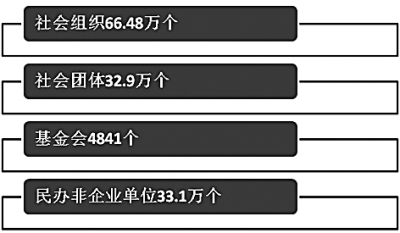

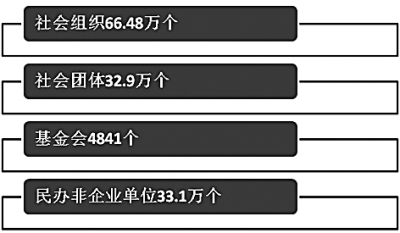

(D) the inertia of the traditional system. The outstanding performance is as follows: first, the concept lags behind, the "end of the story" is reversed, and the value orientation of social governance is misplaced. When some departments perform social governance functions, their value orientation is not based on the concept of "citizen standard", "society standard" and "rights standard", but on "official standard" and "government standard", which seriously affects the government’s social governance function. Second, pay attention to economic growth and despise social development. Taking GDP as a hero leads to the disharmony between social development and economic development, and social development lags behind economic development for at least ten years. Third, the party and government are not divided, and the political society is not divided. Before the reform and opening up, we distorted the Marxist concept of state in practice, copied the Soviet model, and formed a governance system of "nationalization of social governance", which led to the integration of political parties, the state and society, and led to the party’s over-concentration and meticulous governance of social affairs. Fourth, the transformation of government functions is not in place. It should be acknowledged that great achievements have been made in government reform over the years, government functions have changed greatly, service awareness has been greatly enhanced, and the construction of service-oriented government is continuing to advance, but there are still many aspects that need reform. Fifth, the development of social organizations is not enough, and the space for playing its role needs to be improved. As of the first quarter of 2016,There are 664,800 social organizations with competent departments and registered by civil affairs departments, including 329,000 social organizations, 331,000 private non-enterprise units and 4,841 foundations. Social organizations have initially played an important role in social governance and public services, but on the whole, their development is not mature enough, which is mainly manifested in four aspects: First, they have a strong administrative color and low autonomy. Judging from the existing social organizations in China, most of the social organizations that are more influential in society are government-run, government-run, or have a high degree of government-run. Second, the composition structure is unreasonable and its function needs to be improved. At present, the development of social organizations in China is very uneven. Mutual benefit organizations, especially mutual benefit economic organizations, such as trade associations and chambers of commerce, develop rapidly, while public welfare social organizations, such as foundations and private non-enterprise units, develop relatively slowly. Third, the legal system of social organizations is not perfect. At present, there is no Social Organization Law to regulate and protect the activities of social organizations. Fourth, the understanding is not in place and the function of social organization is not well understood.

3. Innovative basic ideas and solutions of social governance.

The basic ideas of innovating social governance should be: we must focus on safeguarding the fundamental interests of the overwhelming majority of the people, give full play to the leading, collaborative, autonomous, self-disciplined and mutual-disciplined roles of multiple subjects in social governance, integrate social governance resources, and form a pluralistic governance structure; It is necessary to organically combine the rule of virtue with the rule of law, so that the rule of law plays an increasingly important role in regulating society; We should let all kinds of forces conducive to social stability and the growth of a harmonious society compete in generate, comprehensively promote the construction of a peaceful China, safeguard national security, and ensure that people live and work in peace and contentment, social stability and order, and national security and harmony.

To this end, we should solve three basic problems in path selection and key grasp.

(A) What does social governance govern: "two levels and one tone"

Social governance is mainly a process in which party committees, governments and various social organizations regulate the behavior of social members by means of law, administration and morality, and organize, coordinate, serve, supervise and control social public affairs in order to promote the coordinated operation of the social system. The purpose of doing this is to meet the social needs of the broad masses of social members, solve social problems, resolve social risks, and achieve social stability, order and vitality. The author makes a systematic review of the central government’s literature and academic viewpoints on social management and social governance in the past ten years, and thinks that the content of social governance can be summarized into three aspects, which are referred to as "two levels and one tone" for short, including: first, the platform construction of social governance, including the establishment of a new pattern and system of social governance, and the establishment and improvement of social organizations and community platforms. The second is the construction of peace, covering social security, emergency mechanism, national security construction and other fields. The third is to coordinate three relationships, namely, the relationship between dominance and subjectivity, maintaining stability and safeguarding rights, and the relationship between the rule of law and the rule of virtue.

According to a large number of investigations and observations, at present, in the actual work in various places, daily social governance is mainly in two aspects, one is safe construction, and the other is guaranteed work. The former is mainly done by the Political and Legal Committee, the Public Prosecution Law and the Letters and Calls Department; The latter is mainly responsible for civil affairs, social security and other departments. As a relatively independent social governance system, it should have richer connotations, including the three major aspects mentioned above. The specific content can be increased or decreased with the change of the situation, but the big framework should be relatively fixed.

(B) Who will govern social governance: multi-subject governance.

Since modern times, the understanding of governance subject in foreign theoretical circles has gone through three stages. The first stage was after World War II. Influenced by Keynesianism and the trend of thought of welfare state, public administration theory occupied the mainstream, and the government took care of a series of affairs such as social policy. In the second stage, after 1980s, the new public governance theory characterized by drawing lessons from corporate governance became popular. American scholars Gueble and Osborne put forward in their book Reinventing Government that the function of the government is to steer, not to paddle, that is, many government responsibilities can be outsourced through contracts. The third stage is the beginning of the 21st century, when the new public service theory rises. The representative work of this theory — — Denhardt’s book "New Public Service" puts forward that the government’s duty is to serve, not to steer, and the government should try its best to meet the individual needs of citizens, not to make decisions for the people. These viewpoints are instructive for us to understand the new pattern and system of social governance with China characteristics.

The report of the 18th National Congress of the Communist Party of China put forward that it is necessary to "speed up the formation of a social management system under the leadership of the Party committee, with the government taking responsibility, social coordination, public participation and the guarantee of the rule of law". This statement clearly shows that the main body of governance is pluralistic, and the biggest difference from the traditional highly centralized social governance system is the emphasis on social coordination, public participation and legal construction. The implementation of this point will greatly change the relationship between the state and society and take substantial steps towards "small government and big society". Party committees should "grasp the big picture", mainly "look up at the road" and do a good job in the top-level design of social governance values, strategic planning and system construction. The government is mainly responsible for "serving". According to the requirements of changing functions, rationalizing relations, optimizing structure and improving efficiency, we should improve the government responsibility system, strengthen social governance functions, strive to build a service-oriented government, provide more and better public services, and meet the diversified needs of citizens. Social coordination, the key point is to give full play to the synergy of mass organizations such as workers, young women, grassroots mass autonomous organizations and social organizations, and form a social governance and public service network in which the party Committee, government and social forces are interconnected, complementary and interactive. Compared with the government, social organizations have the natural advantages of social network and social capital, which can extend their tentacles into the daily life of ordinary people and deeply understand the individual demands of citizens. Public participation, mainly "Autonomy ",without social autonomy, there will be no social good governance. It is necessary to widely mobilize and organize the masses to participate in social governance and public services rationally and orderly according to law, so as to realize self-governance, self-service, self-education and self-development. Social governance is a governance in which the whole society participates. We must mobilize the enthusiasm of every citizen and form a good situation in which everyone participates in social governance and everyone shares in a harmonious society. The guarantee of the rule of law is mainly about means. Governing the country according to law is our general requirement. As a part of the whole social system, social governance also needs the fundamental guarantee of the rule of law. The Central Committee of the Communist Party of China’s Decision on Several Major Issues of Comprehensively Advancing the Rule of Law, adopted by the Fourth Plenary Session of the 18th CPC Central Committee, has played a great role in standardizing and improving the level of social governance from the perspective of emphasizing the role of the rule of law.

(C) How to manage social governance: establish a correct value orientation and take a multi-pronged approach.

1. Innovate the concept of social governance and focus on solving the problem of who governance is for. First, we must firmly establish the people-oriented concept. In the final analysis, social governance is to govern and serve people, and constantly realize, safeguard and develop the fundamental interests of the overwhelming majority of the people. Second, we must firmly establish the concept of service priority. Comrade Deng Xiaoping once pointed out that "leadership is service". Today, we innovate the concept of social governance, especially keeping in mind the teaching of Comrade Xiaoping. Third, we must firmly establish the concept of the rule of law. When the report of the 18th National Congress of the Communist Party of China proposed to speed up the formation of a social governance system, the article "guarantee by the rule of law" was added in particular, which showed that social governance must be governed by law, both reasonable and legal.

2. Strengthen the leading role and service function of the government in social governance, and solve the problem of excessive governance and governance gaps. The so-called excessive governance means that for the same problem, many social governance subjects have to govern and show their authority. As a result, the multi-headed governance, offside for profits and cross-dislocation, the more the governed object is governed, the more it dies. When it is really necessary to solve the problem, the governance subjects are unclear in their responsibilities, buck passing and internal friction, and they have the name of governance without the reality of governance. The common people often say that "nine big caps are holding a broken straw hat" and "Kowloon controls water and floods are endless", which is the truth. The so-called governance gap is that the pipe is unattended and can’t be managed, and there is a blind spot. The government should provide public services wholeheartedly and truly transform into a service-oriented government.

3. Build a social organization platform, actively cultivate and develop social organizations, and solve the problem of no resources for social governance. At present, many social organizations in China are facing the difficulties of capital shortage. The measures that can be taken in this regard are: first, the government entrusts management, that is, the government changes the integration of ownership and management rights into the separation of ownership and management rights, and entrusts state-owned welfare facilities to private operators. The successful operation of some social organizations in Pudong, Shanghai, is actually a model entrusted by the government. Second, the government purchases services. The "Thirteenth Five-Year Plan" points out that the government will no longer directly undertake innovative ways of providing public services that can be provided by the government. Can be provided by the government and social capital cooperation, widely attract social capital to participate. The third is government subsidized services. The main idea in this regard is that the state finance directly allocates funds to social organizations to help them realize their functions effectively.

4. Build a good community platform, improve the new community governance and service system, and further strengthen and improve the grassroots social governance and service system. The report of the 18th National Congress of the Communist Party of China puts forward new requirements for the construction of urban and rural communities, that is, to establish a new community governance system with the leadership of community party organizations as the core, the residents’ autonomy as the foundation, the extensive participation of residents, and the interaction and cooperation of various community organizations, so as to effectively improve the level of community governance. Orderly governance, perfect service, civilization and peace are the general requirements for community construction. Standing in the community to see the community, the community is called the community name area, and the community construction should be socialized; Looking at the community outside the community, the community is named as a famous community. We should pay attention to the integrity of community construction and give play to the overall role of the government. Some problems that cannot be solved in the community must be coordinated and solved by the government.

5. Extensive mobilization to attract public participation. To strengthen and innovate social governance, we must widely mobilize and organize citizens to participate in social governance rationally and orderly according to law, guide citizens to understand their responsibilities and obligations while enjoying their rights, and unify rights, responsibilities and obligations.

To strengthen and innovate social governance, it is essential to establish a new service concept based on society and guided by residents’ needs, to create a new balance between vitality and stability, and to build a new relationship between government and society. At present, the main task is to promote the refinement of social governance under the new requirements of innovative social governance system and build a social governance pattern that all people build and share.

(Xie Zhiqiang, the author is a professor at the Party School of the CPC Central Committee)