Stock trading depends on Jin Qilin analyst research report, which is authoritative, professional, timely and comprehensive, and helps you tap the potential theme opportunities!

Source: shanghai securities news.

Original title: ", responded "

On November 25, in response to the online BYD terminal promotion event,BYD responded: "This promotion is limited to November, not an official price reduction. The purpose of the promotion is to accelerate the conversion of oil to electricity. "

Recently, feedback from BYD dealers showed that the cash discount range of Qin, Han, Tang, Song and other models of Wangchao.com was expanded to 3,000 to 10,000 yuan.

Pictured: BYD Auto Chaozhou Caizhi 4S Store Source: Shanghai Securities Journal reporter Qiu Dekun Photographed

The price of ocean net models has not been significantly loosened, maintaining a decline at the beginning of the month.

From the beginning of November to the end of November, behind BYD’s two price cuts, it hit the "last mile" near the end of the year, with the intention of completing the annual sales target of 3 million new energy vehicles.

At the semi-annual performance meeting in 2023, Wang Chuanfu, chairman of BYD, said: "BYD will fight a price war in the next three to five years, or fight a price war in the segmentation field, and BYD is fully prepared."

"involution" and "price reduction" have been the key words in the domestic automobile market. Zhang Zhuo, general manager of BYD Ocean Network Sales Division, recently admitted: "The volume of the whole market should last for a long time".

Why does BYD promote sales?

BYD’s monthly sales hit record highs, with sales of 301,800 vehicles in October 2023 and 2,381,500 vehicles in the first ten months of 2023.

Such a strong monthly sales volume is not enough. BYD will sell 3 million new energy vehicles in 2023, and the average monthly sales volume in November and December will reach about 309,300 vehicles, that is, the monthly sales volume needs to reach a new high.

This is the direct reason for BYD to increase sales promotion.

BYD officially announced a price reduction promotion, starting from September.mainThree times. Among them, BYD officially announced on September 2 that the 2023 yuan Pro exclusive limited-time car purchase preferential policies, including the purchase price of 2,000 yuan to 8,000 yuan, the lifetime warranty of the three-power system (the first owner), and the lifetime free OTA system upgrade.

By November, BYD had promoted twice, involving various models of Dynasty Net and Ocean Net respectively.

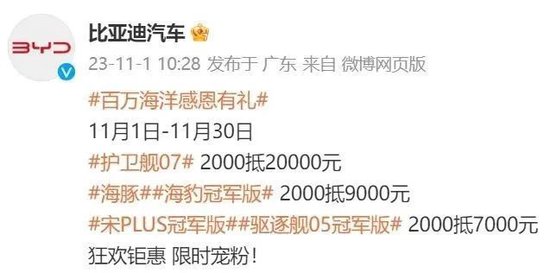

Among them, from November 1 ST to November 30 th, BYD launched a million ocean gratitude and courtesy activities, and the frigate arrived at 20,000 yuan from 07: 00; Dolphin and seal champion edition: 2000 to 9000 yuan; Song PLUS Champion Edition and Destroyer 05 Champion Edition: 2000 to 7000 yuan.

What is the confidence of promotion?

On the one hand, BYD promotes sales, and on the other hand, Tesla raises prices.

Tesla official micro-news, since November 21, the price of Model Y long-life version has been raised by 2,000 yuan to 304,400 yuan.

This is the fourth time that Tesla has raised the price in less than a month.

On October 27th, the price of Model Y high-performance version was first raised by 14,000 yuan to 363,900 yuan;

On November 9, the Model Y long battery life version was raised by 2,500 yuan to 302,400 yuan, and the Model 3 long battery life version was raised by 1,500 yuan to 297,400 yuan;

On November 14th, the Model Y rear-wheel drive version was raised by 2,500 yuan to 266,400 yuan, and the Model 3 rear-wheel drive version was raised by 1,500 yuan to 261,400 yuan.

Tesla was previously known as the "price butcher", mainly because since 2023, with the advantages of brand and high gross profit, it has repeatedly cut prices around the world to seize the market.

This has led to pressure on Tesla’s performance. In the third quarter of 2023, the total revenue was about 23.4 billion US dollars (about 171.2 billion yuan), a year-on-year increase of 9%; The net profit was about $1.9 billion (about RMB 13.9 billion), down 44% year-on-year.

On the other hand, BYD’s net profit in the third quarter of 2023 exceeded 10 billion yuan, which was comparable to the net profit in the first half of 2023.

Source: BYD’s third quarterly report in 2023

In terms of gross profit margin, BYD surpassed Tesla in the first half of 2023 and further widened the gap in the third quarter of 2023.

In the third quarter of 2023, BYD’s gross profit margin was 22.1%, up 3.4 percentage points from the previous month, mainly due to the improvement of product structure and the volume of high-end models.

In the third quarter of 2023, Tesla’s gross profit margin was 17.9%, which was the worst level in the past two years, mainly due to the continuous price reduction of its main models.

Car companies continue to "involute"

In Charles Munger’s view: "Wang Chuanfu is better at actually making things than Musk."

BYD announced that in the third quarter of 2023, despite the intensified competition in the industry, the company’s performance showed strong resilience. An important reason was the continuous expansion of scale advantages and strong industrial chain cost control capabilities.

UBS previously dismantled BYD’s model "Seals", and the cost was 15% lower than that of Tesla, which is famous for its large-scale cost reduction.

On October 31st, Bank of Communications International released a research report saying that BYD will have pricing power in the new energy passenger car market below 200,000 yuan depending on the advantages of supply chain.

According to industry insiders, with the further release of BYD’s production capacity, its control over the industrial chain is getting stronger and stronger, and the cost will continue to decline under the scale effect.

On November 24th, BYD announced that the 6 millionth new energy vehicle rolled off the assembly line in Zhengzhou factory, becoming the first car company in the world to reach this milestone.

Source: BYD

BYD’s ability to produce new energy vehicles continues to increase. It takes 13 years from the first to the millionth, one and a half years from the first to the third, less than nine months from the third to the fifth, and more than three months from the fifth to the sixth.

Previously, Yu Chengdong, managing director of Huawei, CEO of terminal BG and chairman of smart car solutions, said that in order to speed up the delivery of vehicles as soon as possible, 20,000 workers were added to the entire industrial chain and supply chain. In order to accelerate the development of the supply chain, Huawei invested another 1 billion yuan.

In contrast to its strong production capacity, BYD’s share price has recently declined, closing at 216.85 yuan/share as of November 24, down 5.24%, with a market value of 623.8 billion yuan.

What worries the outside world is that BYD has gradually joined the "price war", which highlights the unfavorable signal behind it.

Zhang Zhuo said that 2025 is the last year when the purchase tax will be completely exempted. After two rounds of price wars, many car companies will not survive.

Judging from the third quarterly report of car companies in 2023, the "price war" has led to a common phenomenon of "increasing income without increasing profits", and the net profit of some car companies has dropped, revealing that the competition in the industry has become fierce.

The problem is that the current new energy car companies are constantly "involuting" in price and are also seeking product iterative innovation.

He Xiaopeng, chairman of Xpeng Motors, revealed that behind the new G9, Xpeng Motors has undergone all-round changes from organization to products to technology and marketing.

According to BYD, innovative technology has created leading products. The company has 11 research institutes, and has applied for more than 40,000 patents worldwide and obtained more than 28,000 authorized patents, laying a solid foundation for the development of new energy technologies.

In the face of the "advanced competition" of new energy car companies, car companies can’t keep up with the pace of market competition and face the risk of being eliminated at any time.

Editor: Zhan Xue and Shao Ziyi

Proofreading:Sun jiehuaPhoto editor: Zhao Yanzhen

Examined by: Zhu Jianhua Producer: Zhang Xiaoguang Issued by: Pan Linqing.